|

I look forward to taking care of all your real estate needs. (510) 506.2072 or ilipetski@gmail.com. Compass CAL BRE #01372992 IzabellaLipetski.com

November 20, 2014

November 12, 2014

Ready To Buy a House? (from CNN Money)

Tips for buying a house

The top 10 things you need to know when buying a home.

1. Don't buy if you can't stay put.

If you can't commit to remaining in one place for at least a few years, then owning is probably not for you, at least not yet. With the transaction costs of buying and selling a home, you may end up losing money if you sell any sooner - even in a rising market. When prices are falling, it's an even worse proposition.

2. Start by shoring up your credit.

Since you most likely will need to get a mortgage to buy a house, you must make sure your credit history is as clean as possible. A few months before you start house hunting, get copies of your credit report. Make sure the facts are correct, and fix any problems you discover.

3. Aim for a home you can really afford.

The rule of thumb is that you can buy housing that runs about two-and-one-half times your annual salary. But you'll do better to use one of many calculators available online to get a better handle on how your income, debts, and expenses affect what you can afford.

4. If you can't put down the usual 20 percent, you may still qualify for a loan.

There are a variety of public and private lenders who, if you qualify, offer low-interest mortgages that require a small down payment.

5. Buy in a district with good schools.

In most areas, this advice applies even if you don't have school-age children. Reason: When it comes time to sell, you'll learn that strong school districts are a top priority for many home buyers, thus helping to boost property values.

6. Get professional help.

Even though the Internet gives buyers unprecedented access to home listings, most new buyers (and many more experienced ones) are better off using a professional agent. Look for an exclusive buyer agent, if possible, who will have your interests at heart and can help you with strategies during the bidding process.

7. Choose carefully between points and rate.

When picking a mortgage, you usually have the option of paying additional points -- a portion of the interest that you pay at closing -- in exchange for a lower interest rate. If you stay in the house for a long time -- say three to five years or more -- it's usually a better deal to take the points. The lower interest rate will save you more in the long run.

8. Before house hunting, get pre-approved.

Getting pre-approved will you save yourself the grief of looking at houses you can't afford and put you in a better position to make a serious offer when you do find the right house. Not to be confused with pre-qualification, which is based on a cursory review of your finances, pre-approval from a lender is based on your actual income, debt and credit history.

9. Do your homework before bidding.

Your opening bid should be based on the sales trend of similar homes in the neighborhood. So before making it, consider sales of similar homes in the last three months. If homes have recently sold at 5 percent less than the asking price, you should make a bid that's about eight to 10 percent lower than what the seller is asking.

10. Hire a home inspector.

Sure, your lender will require a home appraisal anyway. But that's just the bank's way of determining whether the house is worth the price you've agreed to pay. Separately, you should hire your own home inspector, preferably an engineer with experience in doing home surveys in the area where you are buying. His or her job will be to point out potential problems that could require costly repairs down the road.

A Luxury Home Hits the MLS in San Francisco

2950 Pacific Ave,

San Francisco, CA 94115

7 beds, 6.5 baths, 11,500 sqft

For Sale $18,000,000

Est. Mortgage $67,393/mo

Welcome to 2950 Pacific Avenue, located on the Gold Coast of San Francisco! This magnificent home is characterized by beautifully proportioned public and private rooms with expansive views of the iconic Golden Gate Bridge, the sparkling Bay, Alcatraz and Angel Islands, Mount Tamalpais, and the Marin Headlands. The distinctive Dutch Colonial Revival home designed by the renown Bay Area architect, Albert L. Farr, exhibits the finest of wood craftsmanship, exquisite diamond patterned window works and period lighting. The property sits at the end of a private driveway with a south facing entrance.

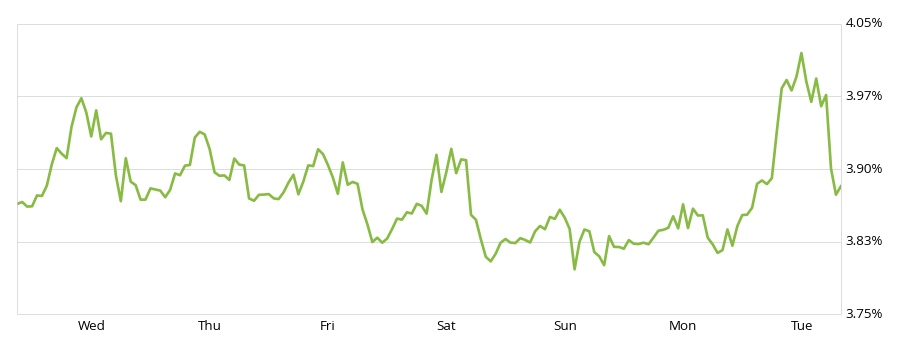

30-Year Fixed Mortgage Rate Firmly Below 4 Percent for the Sixth Week in a Row

Mortgage rates for 30-year fixed mortgages were unchanged this week, with the current rate borrowers were quoted on Zillow Mortgages at 3.90 percent, the same as this time last week.

The 30-year fixed mortgage rate fell early in the week, then spiked to 4.02 percent on Tuesday before settling to the current rate.

“Last week, rates dipped after Friday’s weaker-than-expected jobs report,” said Erin Lantz, vice president of mortgages at Zillow. “This week, with limited economic data scheduled for release and the bond market closed for Veterans Day, we expect rate movement to remain fairly muted.”

Additionally, the 15-year fixed mortgage rate this morning was 3.04 percent, and for 5/1 ARMs, the rate was 2.88 percent.

Purchase Mortgage Application Activity

Zillow predicts tomorrow’s seasonally adjusted Mortgage Bankers Association Weekly Application Index will show purchase loan activity to decrease by 3 percent from the week prior.

*The weekly mortgage rate chart illustrates the average 30-year fixed interest in six-hour intervals.

Alameda Real Estate Market View

Average Listing Price

- $859,880

- for week ending Nov 05

- +$55,982

- +7.0%

Median Sales Price

- $725,000

- Aug '14 - Nov '14

- +$125,000

- +20.8%

Home Standings

Subscribe to:

Posts (Atom)

-

. ~ Your Satisfaction is My Success ~ #Izabella #luxuryrealestate #bayarea #luxury #realestate #milliondollarlisting Should you buy a hou...

-

. ~ Your Satisfaction is My Success ~ #Izabella #luxuryrealestate #bayarea #luxury #realestate #milliondollarlisting Fruit for thought: ...

-

IZABELLA’S ANNUAL HOLIDAY TOY DRIVE Saturday, December 18, 2010, 10am-1pm Please participate in my annual toy drive by bringing a new, unw...